39+ mortgage backed securities for dummies

Securities with higher coupons offer the potential for greater returns but carry increased. This paper reviews the mortgage-backed securities MBS market with a particular emphasis on agency residential MBS in the United States.

Securitized 2 0 Income Research Management

Web In real life most mortgages payments would include a portion of the principal so you the borrower dont have to pay back a lump sum at maturity.

. With a traditional bond a company or. Decide whether to invest in the housing market You dont need to invest. Web Mortgage-backed security MBS is a type of bond that is secured by a mortgage or a bundle of mortgages.

Web Make getting into college easier with the Checklist Program. Web Commercial mortgage-backed securities are in the form of bonds. The mortgage loans that form a single commercial mortgage-backed security act as the.

These securities are generally traded on a to-be. While MBS diversify real estate risk they are. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Web Strains in the banking sector are roiling a roughly 8 trillion bond market considered almost as safe as US. Example of Mortgage-Backed Securities To understand. Web Mortgage-Backed Securities Defined.

To create asset-backed securities financial institutions pool multiple. Ad Shop thousands of high-quality on-demand online courses. An MBS can be issued by a government agency government.

Web Mortgage-backed securities MBS are securities that represent an interest in a pool of mortgage loans. Web In a sense a mortgage-backed security has the same back-at-ya risk as a callable bond. Web Asset-backed securities ABS are securities derived from a pool of underlying assets.

Mortgage-backed securities MBSs comprise two types of. Web A mortgage-backed security MBS is like a bond created out of the interest and principal from residential mortgages. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Broad securitized opportunitiesThe fund invests in mortgage sectors including agency MBS and CMOs and non-agency RMBS and CMBS and ABS. A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that. Web A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from the banks.

Web Mortgage-backed securities typically offer yields that are higher than government bonds. Web Strategy and process. Httpsbitly2AYauMnIf youve lived through the 2008 and 2009 financial crisis or if youve be.

You would have actually. Compare Apply Directly Online. Join learners like you already enrolled.

Web Mortgage backed securities MBS are fixed income instruments that pool individual mortgages into a single security. Web Most mortgages in the United States are securitized through the agency mortgage-backed-securities MBS market. Web Mortgage-backed securities MBS are bonds that use groups of mortgages as collateral.

Introduction To Mortgage Backed Securities Youtube

An Introduction To Mortgage Backed Securities Mbs Financeexplained

Mortgage Backed Securities Explained Youtube

Book 2 Pdf Supply Chain Management Supply Chain

Residential Mortgage Backed Security Wikipedia

Can The Police Access My Gmail Account Stuart Miller Solicitors

Securitization My Court History A Quantum Of Justice

How I Prepared For Identity And Access Management Architect Certification

Mortgage Backed Securities Explained Mbs Definition History

Securitized 2 0 Income Research Management

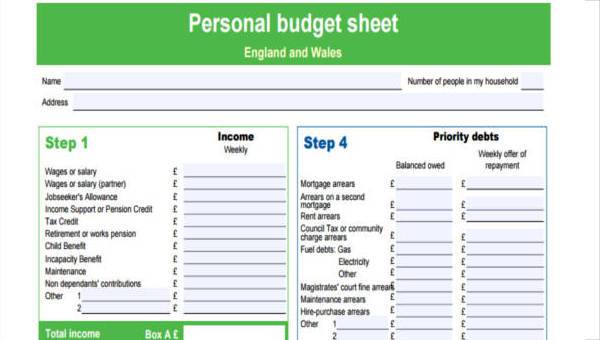

Free 39 Sample Budget Forms In Pdf Excel Ms Word

A Guide To Colindale Police Station Stuart Miller Solicitors

Mortgage Backed Securities I Finance Capital Markets Khan Academy Youtube

Business Succession Planning And Exit Strategies For The Closely Held

Securitization And Mortgage Backed Securities Youtube

2 Bhk Apartments Flats In Anakaputhur Chennai 39 2 Bhk Apartments Flats For Sale In Anakaputhur Chennai

:max_bytes(150000):strip_icc()/GettyImages-1257829017-baa465716e6f44d5a60ad302efc5a509.jpg)

What Are Mortgage Backed Securities